Blog

Blog test 2

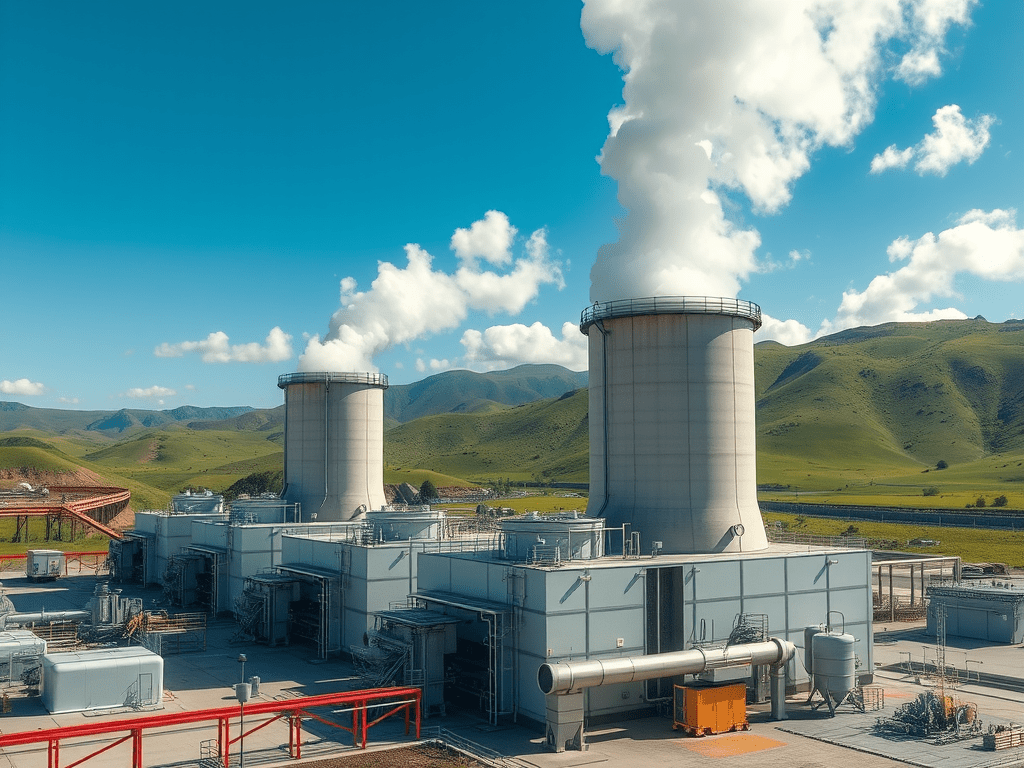

5.2 Next‑gen geothermal (EGS and closed‑loop)—what the market implies for hardware

The IEA’s 2024 assessment puts global next‑gen geothermal potential around 30 GW by 2035 in a medium‑cost case, rising toward 120 GW by 2035 if costs fall faster. Almost all of that sits in a temperature window that naturally points to binary cycles. In other words, the default conversion hardware for next‑gen through 2035 looks like ORC‑class trains, with CO₂ blocks as an option when compact exchangers are industrialized and standardized blocks are proven.

Most of the near‑term demand is likely to concentrate where project pipelines, manufacturing capability, and policy pull overlap. By 2035, China, the U.S., and India together account for a large majority of next‑gen potential. Using a conservative share for the U.S. of roughly 20–35% suggests a domestic equipment demand in the range of ~6–10 GW in the medium case and ~25–40 GW in the low‑cost case. Those are directional ranges to size factories and framework buys—not precise forecasts—but they’re enough to inform investment in domestic capacity.

5.3 Conventional (hydrothermal) geothermal—steady additions with a binary tilt

On the conventional side, global capacity is projected around ~22 GW by 2030 and trending toward ~60 GW by mid‑century. A straight‑line read to 2035 lands near ~31–32 GW, implying ~16–17 GW of additions between 2023 and 2035. A meaningful share of new builds uses binary cycles—Türkiye’s growth and recent U.S. additions are examples—so ORC demand doesn’t hinge entirely on next‑gen.

BLog POst 1

blog post test